In the Senate Healthcare Bill, Do Premiums Increase or Decrease?

On Monday, November 30, the Congressional Budget Office released its analysis on the effect of the proposed healthcare reforms in the Senate’s version of the bill on health insurance premiums. Both Democrats and Republicans have seized on this report’s conclusions to support their positions on healthcare reform legislation. Democrats have emphasized that beneficiaries in the non-group market (beneficiaries who purchased individual or family policies on their own, not through their employer) would pay lower premiums, on average, under the Senate’s reform bill, once the impact of government subsidies is taken into account. Republicans, on the other hand, have emphasized the increase in premiums in the non-group market, excluding the impact of government subsidies.

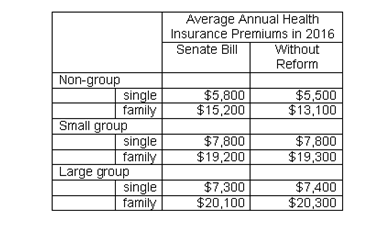

While both of these positions are accurate, it should be emphasized that the non-group market, while expanding under healthcare reform, will still account for a relatively small share of the overall insurance market. The vast majority of the non-elderly will still receive insurance from their employers, with 70% in the large group market and 13% in the small group market (in the CBO’s analysis, “small group” is defined as employers with 50 employees or less). Only 17% of non-elderly beneficiaries would be covered in the non-group market, and these non-group policies would be purchased through the new insurance exchanges. Average premiums for both the small group and large group policies would essentially be unchanged, or may even decrease under the Senate bill, according to the CBO’s analysis.

For the non-group market, however, average annual premiums would increase from $5,500 to $5,800 for singles under the Senate bill, while average annual premiums for families would increase from $13,100 to $15,200 under the Senate bill. For 57% of beneficiaries, however, the actual cost would be substantially lower because their premiums would be subsidized by the federal government. Moreover, the biggest reason for the increase in premiums in the non-group market under the Senate reforms is because the insurance coverage provisions of the new policies would be much better, on average, than current policies in the non-group market. Under the reforms, the insurance coverage for policies in the non-group market would be essentially the same as current group market policies, in contrast to current policies in the non-group market, which often offer poor coverage. Other effects of reform, such as slightly lower administrative costs and a slightly healthier pool of beneficiaries, serve to slightly offset the increase in premiums associated with the more comprehensive coverage provisions.

Therefore, according to the CBO’s analysis, average health insurance premiums for most beneficiaries would remain essentially unchanged under the Senate’s version of healthcare reform. In the non-group market, however, premiums would increase, primarily because of better insurance coverage, although 57% of beneficiaries in the non-group market would receive significant subsidies, so their costs would be much lower than the average premiums.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home